Blog

Insights, tools, and training straight from the team at Compass Point

BLOG | LEADERSHIP

Unequivocal Responsibility OR Something Less

Unequivocal responsibility-taking does not come naturally. True, we have an innate sense of when we’ve harmed others – the conscience inevitably pricks at us. However, we all also have an ingrained tendency to seek escape from consequences and accountability. We know what we should do, what we need to do, and yet we flee from it.

Read Post

BLOG | FAMILY DYNAMICS / GOVERNANCE

The 4-Letter Word Owners Can’t Afford NOT to Talk About: EXIT

I’ve had my share of family business owners who avoid discussing this four-letter word to the point of pure denial, quickly ending the conversation when this word bubbles up. The word? E-X-I-T. It sounds so final. The brutal truth is that 100% of owners exit the business, yet only 50% – just 1 out of 2 owners – will do it on their terms...

Read Post

BLOG | LEADERSHIP

Family Business Peer Groups are Gamechangers for the Next Gen

Many family-led companies hire business consultants to grow the business. Some even send their emerging leaders to personal development programs. But there is a gap – and it’s a BIG one.

Read Post

BLOG | PEOPLE / TALENT

Unlocking the Golden 5% in Your Employees

The Golden 5% is the full expression of our ability, multiplied by our maximum possible effort, multiplied by our full contribution of heart. It is the performance equivalent of what we offer in a deeply loving relationship – the absolute best of ourselves. And yet, we rarely give it or reliably inspire the giving of it by others in organizations. Why?

Read Post

BLOG | FAMILY DYNAMICS / GOVERNANCE

Business Issues: Identify and solve, or they could cost you.

Part of the challenge in a family business, or any business for that matter, is that the world does not stop and allow you to pursue your strategy in a nice, orderly fashion. Whether it is internal or external, business issues pop up throughout the day. So how do you prevent issues from derailing the company’s progress? Here are a few ideas for minimizing their occurrence and how to deal with them effectively when they do happen.

Read Post

BLOG | PEOPLE / TALENT

How to Coach (or deal with) a Negative Employee

As a leader, it is more likely that you’ll manage a negative employee or situation than not. Whether it is a short-lived instance or a long term issue, it can be manageable with candid conversations. Here are a few steps that work well to address and remedy the situation: Unearth the problem...

Read Post

BLOG | FAMILY DYNAMICS / GOVERNANCE

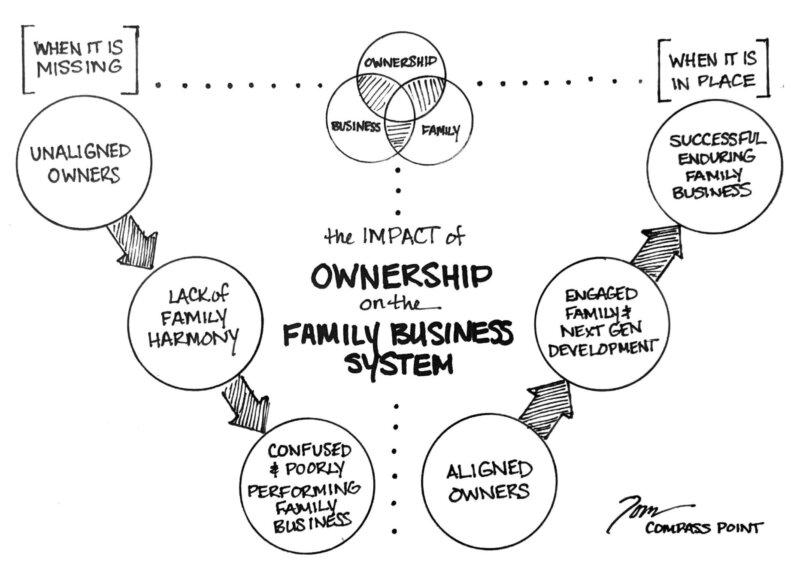

The Many Facets of Ownership

In 1978 the 2-circle illustration of family business evolved when Harvard business professor Renato Tagiuri and then-graduate student John Davis added a third circle – Ownership – to better account for the distinct groups that existed in a family business. With the addition of Ownership, the 3-circle model more accurately captured the seven facets of ownership.

Read Post

BLOG | LEADERSHIP

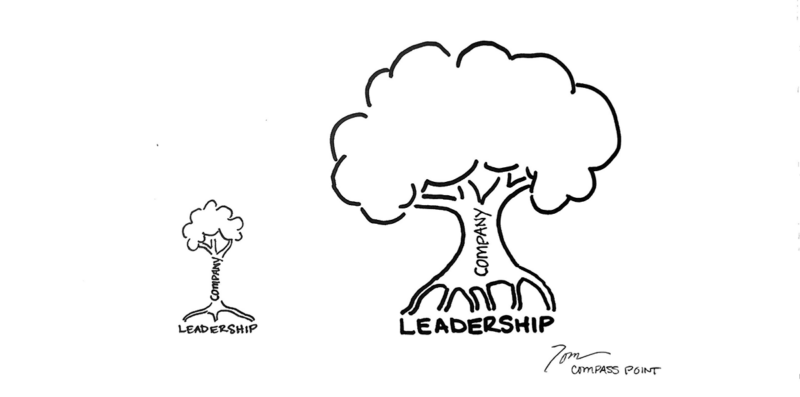

Leadership Is Not What You Think

When I first started Compass Point 20 years ago, leadership was an ancillary topic. My work focused on the systems, financials, hiring the right people, and being a confidant to the owner. At the time I didn’t see it as leadership coaching, but rather as building a relationship with a client who trusted me enough to let me see the inner workings of their mind and business. I helped the person as I helped the business. Times – and leadership – have changed.

Read Post

BLOG | OWNER FINANCIAL GAP

It’s The Simple Math That Doesn’t Get Done

Family business owners are passionate about what they do. They’re working to carry on a business that family built – by their parents, grandparents, sometimes even great-grandparents and beyond. These owners are so busy providing for their employees, communities, and the next generation that they often ignore their own financial future. Boiling it down to its true essence, business is a means to building wealth. And what are we supposed to do with that wealth?

Read Post

BLOG | LEADERSHIP

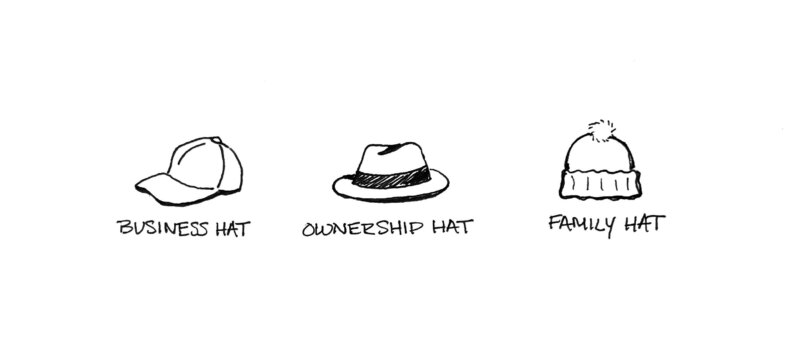

The Many Hats of a Family Business

Product. Team. Customers. Processes. Sales. Revenue. Profit. Cash. These are the elements to any good, viable business. But a family business needs more than just those elements to build a sustainable family business. With many dynamics at play, the business owner needs to understand which "hat" to wear, when to wear it, and when to switch. Do you know how to manage it all?

Read Post

BLOG | LEADERSHIP

Which leader are YOU?

One of the hallmarks of good leadership is to have a mindset of being a lifelong learner. When we continue to learn and apply, we become better leaders, ones who inspire our people to bring the best and who develop and hone the team’s skills to predict and delegate. That's where the lift comes in the business. That's where you take a business from good to GREAT. Great leadership multiplies and amplifies others.

Read Post

BLOG | FAMILY DYNAMICS / GOVERNANCE

A Strong Family Business Isn’t Perfect

Running a family business is a lot like any other business. There are sales goals to meet, market trends to monitor, supply chains to navigate, stakeholders’ expectations to manage and people to hire, fire and develop. Pretty much the same… UNTIL you add FAMILY. And then, there are family dynamics to consider as you chart your business's course and build a strong family business.

Read Post

BLOG | LEADERSHIP

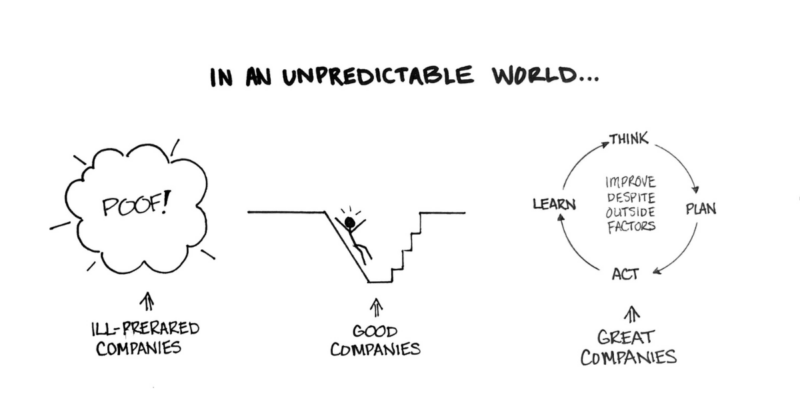

How To Get Predictable Results in Your Family Business in an Unpredictable World

Why do great family businesses improve despite dealing with the same crappy external factors that destroy some businesses and stall others? Because they practice and execute these tenets...

Read PostWhere Family Businesses Come to Grow & Learn

At Compass Point, we make it easy to get insights, training, tools, and articles straight to your inbox and help family business owners and their team continue to grow, learn, and lead.