NEXT CHAPTER

What is Your Lifestyle Number?

More often than not, when I ask business owners what their lifestyle number is I hear either “I don’t know” or “I THINK I need (X)”.

These are smart people. They built a business with revenues exceeding $5 million. Yet despite their hard work and attention to detail, they haven’t asked the right questions or been guided through the right discovery process to find their true lifestyle number.

Three primary factors will drive your answer:

- What is the value of your current assets that can be used in retirement?

- What lifestyle do you desire in retirement?

- How long do these assets need to last?

For a more in-depth look at these, watch the companion video.

How to discover your lifestyle number.

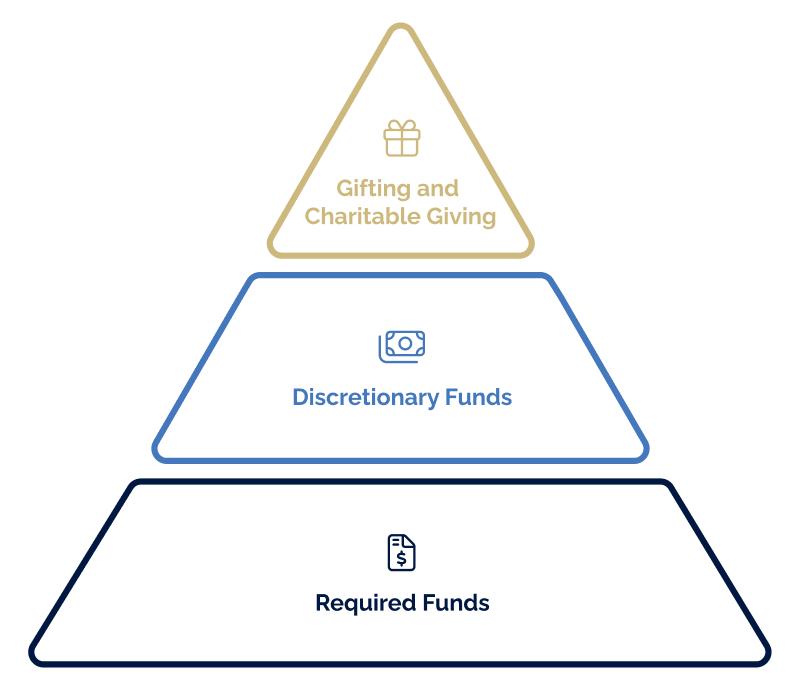

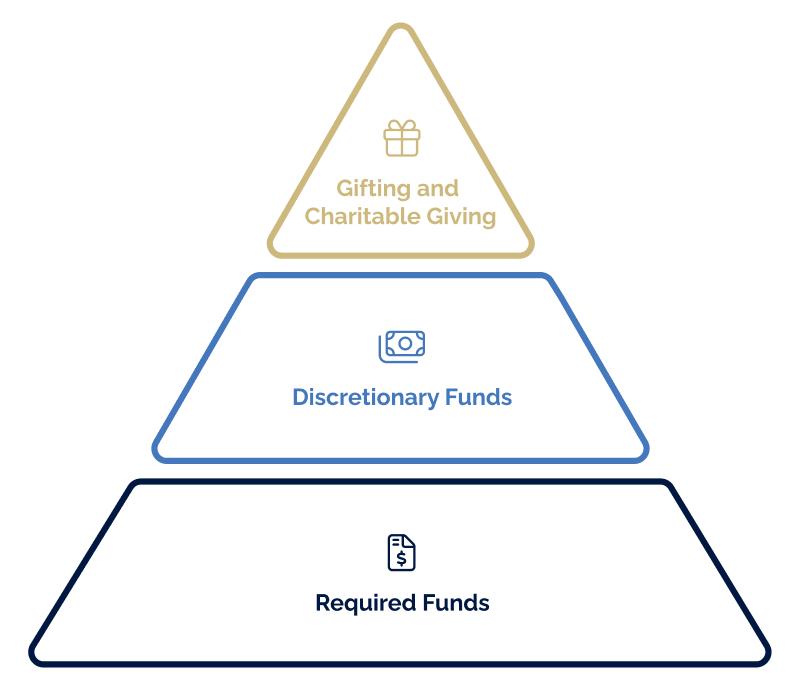

Working with one of our strategic partners, Legacy Planning, our Six Pillars clients leverage a practical tool called the Lifestyle Pyramid that accounts for assets, expenses, and desired lifestyle expectations to find “the number needed” for their next chapter.

Let’s break down the Lifestyle Pyramid’s three tiers:

- Required Funds. These are baseline expenses that recur monthly: utilities, mortgage, insurance, healthcare premiums, and food. If you don’t pay for them, you won’t have them. The goal is to pay these fundamental expenses using guaranteed income sources (like pensions, Social Security, rental income, and annuities). We call this mailbox money — income that comes to your mailbox (or your bank account via direct deposit). Every. Single. Month.

- Discretionary Funds. Next are the fun expenses such as travel, vacations, hobbies, and dining out. These are things in life that we want to do but don’t necessarily need to do. Hence the term discretionary. These will change from year to year as your family changes. Discretionary expenses should be paid for by investment income, such as 401ks, Roth IRAs, joint investment accounts, municipal bond income, or corporate bond income. Just as your discretionary spending may change over time, the same is true for investment income (more on this below).

- Gifts and Charity Giving. At the top of the pyramid are gifts and charities. You may want to make gifts to family members or give to charities that have meaning for you. Again, these gifts and charity donations should be funded by investment income, not your guaranteed mailbox money.

One critical point: investment income is not guaranteed. As interest or dividend rates change so will the rate of return generated from your investments.

To provide for discretionary spending, gifts, and charitable giving consistently, your plan should ensure you have enough cash on hand. Specifically, we recommend two to three years’ worth of cash to fund these categories to stabilize any flux in the market.

Can you fund your lifestyle for another 30 years?

Once the Lifestyle Pyramid is complete, you have the annual lifestyle number you need to meet your retirement goals. Through modeling, we can show you a projection of how long your current assets will last based on this annual spending, investment returns, and inflation.

Today, if you are 65 and relatively healthy, you should plan on living another 30 years. The Lifestyle Pyramid and modeling tell you whether or not your current assets will fund your ideal lifestyle and for how long. If your lifestyle outspends your assets, you have found your value gap.

Business Value – Lifestyle Number = Value Gap

The value gap is the number you need from the sale of the business minus what you need to live, not only today but, down the road when you are no longer collecting a regular paycheck, draw, or distribution from the business. Stop and let that sink in.

You need to know this number BEFORE you transition in order to live your Next Chapter on your terms.

Do you see how important it is that an owner starts working on their Lifestyle Pyramid NOW? Bridging a value gap is much easier while you are still working in the business with time to build value, unlock wealth, and reach desired financial goals for your next chapter.

For help finding your lifestyle number or planning your next chapter, talk with us.