FAMILY DYNAMICS / GOVERNANCE

The Cousin Federation

“The father buys, the son builds, the grandchild sells, and his son begs.” – Scotland

“Rice paddies to rice paddies in three generations.” – Japan

“Clogs to clogs is only three generations.” – England

“Wealth never survives three generations.” – China

“Shirtsleeves to shirtsleeves, in three generations.” – United States

It’s a common phenomenon around the world. Family businesses rise like a phoenix from the ashes, powered by an entrepreneur’s vision and passion to do something better than what existed, transition to the second generation who work to preserve the wealth, only to see the family business return to the ashes from which they rose three generations earlier.

What happens? Why do so few of all family businesses survive to the third generation? And how do you improve your odds?

Let’s start by understanding the lexicon of family business.

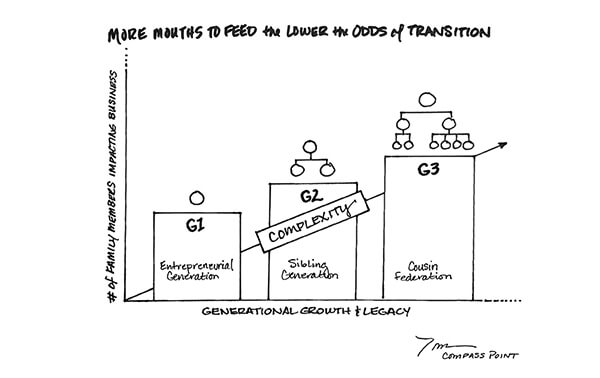

The first generation, G1, is known as the entrepreneurial generation. This is where the business starts, typically driven by a strong entrepreneurial founder who risks everything to bring their vision to life.

The sibling generation, or G2, is where ownership transitions to the children of the founder. Love, power, and money influence the family dynamics considerably. Things can get complicated as sibling rivalry, divorce, or other factors can rear its ugly head, and the entrepreneurial spirit of G1 can start to fade.

Enter G3 – the cousin federation. The G2 children have had children and these cousins come into the family business. If you thought G2 was complicated, G3 can sometimes feel like the Wild West. Varying family values, politics, religion, and personal beliefs among the cousins can sometimes create rifts and divides between the branches of the family.

In Western culture, we believe ‘winners and losers’ are determined by social and cultural factors. But, with the “third generation curse” so universal, it appears human nature itself plays a big role.

Most founders (G1) of multi-generational family businesses surmounted significant adverse odds to survive. The founder’s children (G2) were often close enough to the early life of the family business to see the struggle behind the reward. Some G2 “left the farm” so to speak, while others felt compelled to take on the responsibility of preserving the wealth and legacy of the family business that their parents started.

By the time G3 comes along, the data tells a harsh story. Impatience, irreverence, and a sense of entitlement before responsibility enter the picture. Third-generation members often feel the family fortune has been built and preserved for them and that they are, unquestionably and without restriction, entitled to it. I’ve heard, “It’s my God-given right” more than once.

This needs to be said and for some, it will sting – most G3ers had a comfortable youth and adolescence, and often are not as motivated as their predecessors to work harder than their peers for what they want. Often third-generation members view their predecessors through the lens of these prior generations’ lifestyles rather than recognizing the sense of purpose, passion, hard work, and sacrifice that made these lifestyles possible in the first place.

Another factor? Life expectancies have steadily increased in most of the world. As generations last longer so does their control of the family business, leading to G3 becoming impatient to assume the privileges they perceive previous generations to have effortlessly created and enjoyed – without understanding the responsibility.

And there are simply more mouths to feed in G3. If you haven’t designed any governance in the business about who gets to come into the family business by the third generation, the business is not sustainable. Last name or lineage alone should not mean a fast track to a paycheck in the business.

What can a family business do? Recognize the dynamics of building a multi-gen business, then design and implement family governance. While this is ideally done before G2 steps in, it’s imperative to do so before the G3 “cousin federation” enters the ranks. Family business governance includes things like a family constitution, a board of directors, and a family council. Click here for a brief overview of each of these family business structures.

For a multi-generational family business, the challenge is real. Only 33% of family businesses make it to G2, only 12% of G2 businesses make it to G3, and a meager 4% will survive past G3.

Beat the odds – and the G3 curse. Build a governance plan and ensure those mouths are fed for generations to come.

You may also like…

BLOG | FAMILY DYNAMICS / GOVERNANCE

The 4-Letter Word Owners Can’t Afford NOT to Talk About: EXIT

I’ve had my share of family business owners who avoid discussing this four-letter word to the point of pure denial, quickly ending the conversation when this word bubbles up. The word? E-X-I-T. It sounds so final. The brutal truth is that 100% of owners exit the business, yet only 50% – just 1 out of 2 owners – will do it on their terms...

Read More

BLOG | LEADERSHIP

Family Business Peer Groups are Gamechangers for the Next Gen

Many family-led companies hire business consultants to grow the business. Some even send their emerging leaders to personal development programs. But there is a gap – and it’s a BIG one.

Read More

BLOG | PEOPLE / TALENT

Unlocking the Golden 5% in Your Employees

The Golden 5% is the full expression of our ability, multiplied by our maximum possible effort, multiplied by our full contribution of heart. It is the performance equivalent of what we offer in a deeply loving relationship – the absolute best of ourselves. And yet, we rarely give it or reliably inspire the giving of it by others in organizations. Why?

Read MoreWhere Family Businesses Come to Grow & Learn

At Compass Point, we make it easy to get insights, training, tools, and articles straight to your inbox and help family business owners and their team continue to grow, learn, and lead.