FAMILY DYNAMICS / GOVERNANCE

What’s love (power & money) got to do with family business? EVERYTHING.

When I began my career in family business consulting nearly 20 years ago, I met Dean Fowler, one of the early thought leaders in the field of family business and author of several books, most notably Love, Power and Money.

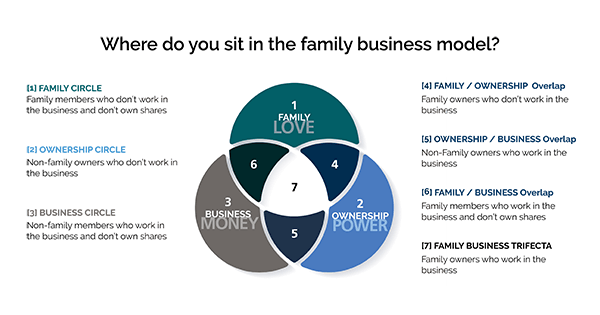

As it turns out, these 3 words line up perfectly with the famed 3-circle model developed by Davis and Tagiuri of the Harvard Business School in 1978, depicting the family business system – the intersecting circles of family, business, and ownership – love, power, and money.

It also turns out that love, power, and money can make generational transitions in family businesses very challenging, to say the least. Especially as the business moves into G2 and then G3, these 3 factors get muddied and blurred.

A common stumbling block is the senior generation wanting to maintain ‘power’ within the family unit as their shares get split among their children. Owners often ignore, deny, or avoid the simple fact that every child may be interested in – or even capable of – running the business. When transitions are not managed well, it’s often because the senior generation is not having the right conversations around love, power, and money that need to be had. In that void, a toxic environment of sibling and cousin rivalries begins to emerge, and when that happens, the end of the business is not far away, generally.

If I have just summed up the current tensions that exist in your world right now, take a deep breath. It’s never too late to start building a healthy family business. And if dysfunction has not yet taken up house in your business, these strategies will keep dysfunction at bay, or at least manageable.

Here are two things you can start doing today:

First, develop and write a family business constitution with all the shareholders of the business. The constitution is a set of guidelines that everyone knows about and agrees to if they want to be a part of the business. It is designed to provide a structure to educate and facilitate communication between family members. It provides assurance to non-family leaders that there is a process for joining the business and that your last name is not a free pass. A family constitution defines the interface between the family and the business and how you’re going to work together as a family in this business. You’ll be amazed at the kinds of discussion, cohesion, and alignment that this creates for the family moving forward.

-

- Discuss and agree on family values

- the purpose of being in your family business

- the family’s vision for the business, employment criteria, etc…

Next, develop a plan for the next generation of leadership. Two things are required to make a transition successful: ownership and leadership. If you do not focus on leadership first, you will not have any ownership to worry about. This is imperative to read again! If you don’t develop the leadership team, there will be nothing to own. Having crucial conversations builds “sweat equity” insurance.

If you are the senior generation of the family business that is beginning to look at transitioning, let the Next Gen come up with the succession plan. Turns out, in many cases, by having Next Gen lead here, they do a lot of the heavy lifting. Of course, you will provide feedback, suggest changes, and ultimately approve it. It’s through this process and series of conversations that you’ll be surprised at how well they did coming up with a plan – including who will be in charge when the baton gets passed. Building out a leadership team and identifying successors to key positions, including yours as the CEO, is a key driver of business value. It creates sweat equity insurance to ensure the business you have built successfully transitions to the Next Gen.

Without a healthy relationship around love, power, and money, dysfunction will surely rear its ugly head and undermine your family, the business, and all of the hard work you have put into both of them.

Because in the end, what do love, power, and money have to do with your family-owned business?

E-V-E-R-Y-T-H-I-N-G.

If you are interested in creating your own family business constitution or coaching the next generation of your team, let’s talk.

You may also like…

BLOG | FAMILY DYNAMICS / GOVERNANCE

The 4-Letter Word Owners Can’t Afford NOT to Talk About: EXIT

I’ve had my share of family business owners who avoid discussing this four-letter word to the point of pure denial, quickly ending the conversation when this word bubbles up. The word? E-X-I-T. It sounds so final. The brutal truth is that 100% of owners exit the business, yet only 50% – just 1 out of 2 owners – will do it on their terms...

Read More

BLOG | LEADERSHIP

Family Business Peer Groups are Gamechangers for the Next Gen

Many family-led companies hire business consultants to grow the business. Some even send their emerging leaders to personal development programs. But there is a gap – and it’s a BIG one.

Read More

BLOG | PEOPLE / TALENT

Unlocking the Golden 5% in Your Employees

The Golden 5% is the full expression of our ability, multiplied by our maximum possible effort, multiplied by our full contribution of heart. It is the performance equivalent of what we offer in a deeply loving relationship – the absolute best of ourselves. And yet, we rarely give it or reliably inspire the giving of it by others in organizations. Why?

Read MoreWhere Family Businesses Come to Grow & Learn

At Compass Point, we make it easy to get insights, training, tools, and articles straight to your inbox and help family business owners and their team continue to grow, learn, and lead.